Today, the world is staring at the threat of tremendous climatic disorder. The purpose of this article is to explore ways in which taxation policies in general and carbon taxes in particular could help deal with this malaise. It is important to work on this area since there is no standardised method of taxation (which is applicable world-wide) to specifically address climate change. Environmental taxes in general are often designed in a manner that they demonstrate less synergy with the overall tax policy landscape. The idea behind this article is to explore the potentially symbiotic association of tax policy with efforts to mitigate the impact of climate change with the help of a carbon tax. The focus of this article will be largely confined to the work done in the EU region.

1 Introduction

1.1 Background

Climate change is the most unshakeable challenge of the times that we are living in. Historically, climate change has decided and sealed the fate of civilizations. The impact of climate change is often all pervasive. The pace of climate change warrants an urgent intervention on multiple levels. Financing policies, schemes and technology to check climate change are some of the many avenues that require resources.

1.2 Purpose & Delimitation

The purpose of this article is to examine how carbon taxes can be used as a means to mitigate the impact of climate change. This article is based on the following thoughts. Firstly, the premise that there is a need to arrive at a climate sensitive tax policy, which is a tax policy which also factors in climate change. Secondly, such a policy should strive to be inclusive as far as possible. Thirdly, this policy model should be able to explore the design for a standardised carbon tax that could be seamlessly employed across jurisdictions in order to be globally relevant. However, the exact design and formulation of a standard carbon tax is beyond the scope of this article. This will only be explored in a brief theoretical manner.

1.3 Method and materials

The research for this paper has been undertaken following a doctrinal method. Accordingly, different statutory provisions and case laws relevant to the scope of the topic have been examined. To the extent necessary, a comparative analysis with other jurisdictions was also briefly undertaken.

I will briefly provide a short summary of the notable materials that have been used for this paper. The United Nations (UN) Department of Economic and Social Affairs in its ‘UN Handbook on Carbon Taxation’ released in 2021 has shed some light in this regard.1 The UN Subcommittee on Environmental Taxation defines environmental taxes as ‘any compulsory, unrequited payment to general government levied on tax-bases deemed to be of particular environmental relevance’.2

The Organisation for Economic Cooperation and Development (OECD) considers environmental taxes as such taxes ‘whose tax base is a physical unit (or a proxy of it) that has a proven specific negative impact on the environment’.3 The IMF has described carbon taxes as environmental taxes that are usually levied on fossil fuels.4 They encourage a shift in consumer as well as producer behaviour towards options that are more environment-friendly.5 Carbon taxes are considered to be relatively easier to impose and monitor.6

The Report of the Inter-governmental Panel on Climate Change (IPCC) released in 2022 has reiterated the impending fate of human civilization, if climate change is not tackled with a sense of extreme urgency.7 For commitments under the Paris Climate Agreement to lead to fruition, emissions must peak by 2025 and then reduce by 2030 by a staggering 43 %.8 The UN Climate Change Conference held in Glasgow in 2021 stitched together the Glasgow Climate Pact after prolonged deliberations.9 This document lays down the key actions and deliverables to be taken in furtherance to the Paris Climate Agreement.10

www.un.org.

Ibid.

www.oecd.org.

www.imf.org.

Ibid.

www.weforum.org.

www.ipcc.ch.

www.weforum.org.

www.ukcop26.org.

www.unfccc.int.

2 Relevance of Carbon Taxes to Tax Policy Making

2.1 Introduction

Carbon taxes are relevant to tax policy because an integrated approach can ensure that desired outcomes can be achieved in a timely manner. As such, carbon taxes must be incorporated into the overall policy framework of a country in addition to the tax policy framework. This will ensure that their niche is calibrated in tandem with other variables, such as economy, commercial production, supply chain etc. It is necessary to understand in what way carbon taxes can help in safeguarding the environment. In order to understand this, it is necessary to define and explore the design of such a tax. This will be the theme of this section.

2.2 Defining a Carbon Tax

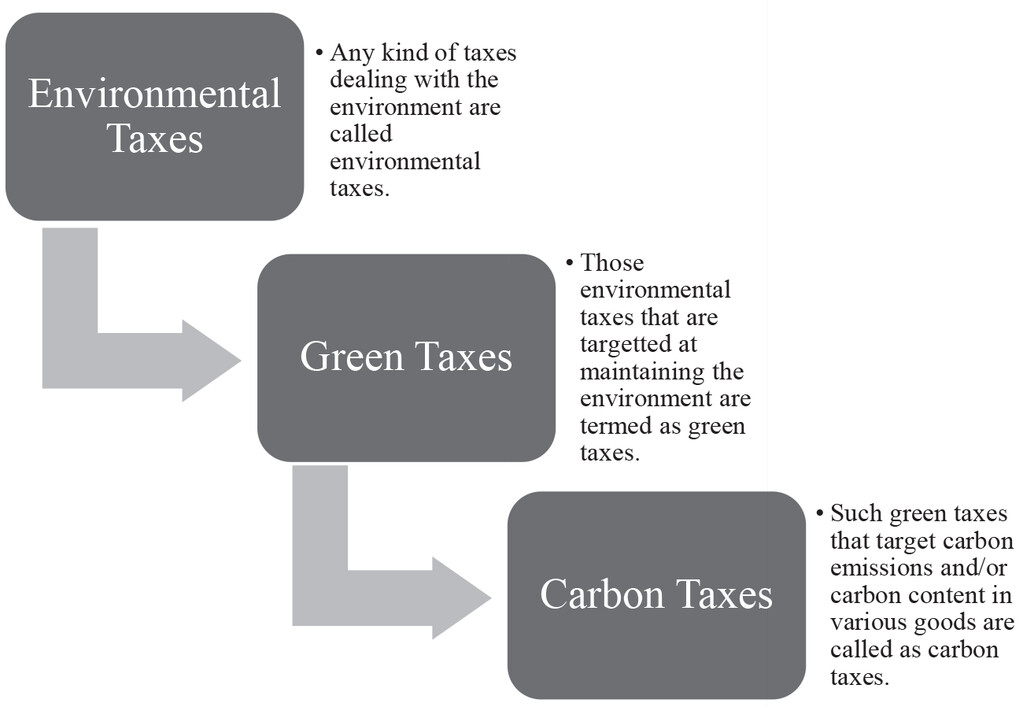

The UN Subcommittee on Environmental Taxation explains carbon tax as taxes which would help in the reducing carbon emissions. The UN Handbook of Carbon Taxes defines carbon taxes as a form of green taxes.11 It further categorises carbon taxes as a sub-set of environmental taxes.12 This is a major step towards understanding and applying carbon taxes, as until this definition was provided by the UN, there was no uniform definition of carbon taxes. The OECD regards environmental taxes as such taxes ‘whose tax base is a physical unit (or a proxy of it) that has a proven specific negative impact on the environment’.13 It is interesting to see that a hierarchy is created between environmental taxes, green taxes and carbon taxes. It is imperative that this interrelationship is appreciated. All carbon taxes are a form of environmental taxes. However, all environmental taxes may not necessarily be carbon taxes. This establishes that these terms should no longer be used interchangeably, as has been the practice often. The delineation is important as it lays a definite scope of the carbon tax.

This difference in definition as provided in the UN Handbook on Carbon Taxes is illustrated as below:14

Figure 1. Flowchart representing the various kinds of taxes pertaining to the environment.15

A fixed definition of a carbon tax is important for many reasons. A definition accords clarity, transparency and certainty to a tax and its goal. The principle of legal certainty is upheld when a clear definition of a tax is provided by the statute,16 as tax-payers know what they are being made to pay for. Further, a well-defined law fits into the broader expectation out of a tax policy. It becomes a tangible, and no longer remains a whimsical effort which confounds people.

A clear definition ensures that administering the law becomes easier. It is less litigated, or even when litigated, it is for credible reasons, and not for the courts to step in to define it in the first place.17 A uniform and consistent definition of the tax, and an overarching legal framework to execute the carbon tax shall only go towards wider acceptability of such a tax. This in turn will ensure greater compliance.18 Over a period of time, this will ensure achieving the desired outcome by addressing the challenges faced during the course of continuing endeavours to check climate change.19

www.government.se.

See UN Department of Economic and Social Affairs (n. 2), paragraph 46; See Generally, Tatiana Falcoa, ‘Highlights of the UN Handbook on Carbon Taxation’, Intertax, Volume 49, Issue 11, 899–901.

www.stats.oecd.org.

See Generally, Tatiana Falcoa, ‘Highlights of the UN Handbook on Carbon Taxation’, Intertax, Volume 49, Issue 11, 899–901. Kindly note, the broad understanding of the definitions provided in the flow-chart are all derived from the UN Handbook on Carbon Taxes and other scholarly writings on the theme of defining carbon taxes.

This flowchart and the definitions provided alongside each box is my understanding of the nuances surrounding the definition of carbon taxes in the UN Handbook on Carbon Taxes and other scholarly writings on the definition of such taxes.

The ‘Principle of Legal Certainty’ is defined by a set of predictable and definite set of laws and regulations.

The ‘Principle of Legal Certainty’ is defined by a set of predictable and definite set of laws and regulations.

See n. 2; See Generally, Marta Villar Ezcurra, ‘Energy Taxation, Climate Change and State Aid Policy in the European Union: Status Quo and the Need for Breakthroughs’ in Pasquale Pistone & Marta Villa Ezcura (eds.), Energy Taxation, Environment Protection & State Aid- Tracing the Path from Divergence to Convergence (IBFD 2016), 25–55.

See Generally, Tatiana Falcoa, ‘Highlights of the UN Handbook on Carbon Taxation’, Intertax, Volume 49, Issue 11, 899–901.

2.3 Formulating a Carbon Tax

Despite the acknowledged relevance of carbon taxes today, there is still no standardised formula of such a tax that could be readily applied by interested jurisdictions. Taxation is a plank that can be a reliable and fast way to raise resources to deal with climate change. The actual task is to figure out a way to compute such a tax, and then to integrate it with taxation policies in a way that it comprehensively delivers on its mandate.

The UN Handbook on Carbon Taxes discusses the concept by defining as well as discussing the two ways to approach it. The first method that the Handbook describes to compute a carbon tax is to measure the carbon content in the fuel being used. This may be alternatively termed as the ‘fuel-based’ approach.20 The second method of ascertaining a carbon tax focusses on measuring the carbon emissions. This method is termed as the ‘direct emissions approach’. It is usually more convenient to tax the carbon content of the fuel than the emissions.21 The entire carbon content is usually accounted for as the fuel is taxed upstream, and prior to consumption.22 A carbon tax definition followed by a formula to levy such a tax can ensure that these can be effectively used by a wide number of jurisdictions.

As a field of study, climate change is an inter-disciplinary area that is the melting-pot of multiple academic streams. Certainly, there will be many ways that lead to the goal of addressing it. Taxation is one such means to check climate change resulting from environmental degradation. For the simple reason that taxation impacts people directly, it warrants examining an approach to mitigate climate change by placing taxation at the core.

It would be interesting to note how tax policy could be interpreted as a means to address this topic. Based on my understanding from the research undertaken for this article, in most countries, taxation and climate change are disjointed ends of policy discourse. If one were to count, there would be a select list of countries that integrate their taxation policy around environmental concerns. The Nordic countries stand out for their efforts at staying ahead of the curve. Finland was one of the first proponents of a carbon tax in the early 1990s.23 The integration of waste management, energy generation and sustainable environment narrative in Sweden demonstrates a highly integrated policy and administrative model.24 It would be worth exploring their success to decipher their methods of implementation and reasons for acceptance by tax-payers. This could probably be instructive for experimentation on a more global level and could lead the way to eventually arrive at a standardised tax policy that could also incorporate a carbon tax. A sound tax policy must be dynamic in accepting the challenges surrounding its acceptance, as much as it should be technically sharp.25 The goal must be to target climate change and work towards its mitigation. The means to achieve that could be carbon taxes.

See n. 2.

See Generally, www.un.org.

Tatiana Falcão, 2019, A Proposition for a Multilateral Carbon Tax Treaty, IBFD Doctoral Series 47, 2019, 8; See Generally, Alice Pirlot, Chapter 15: International taxation and environmental protection, in Yariv Brauner (ed.), Research Handbook on International Taxation, Edward Elgar, 2020, 258–277.

Finland introduced its Carbon Tax in 1990, followed by Sweden in 1991 and Denmark in 1992.

https://www.government.se/.

Abhishek Tripathy, ‘Imagining the Contours of a Climate Inclusive Taxation Policy’, Indian Journal of International and Comparative Law, Thomson Reuters, Volume I, Issue I, February 2023, pp. 117–131.

3 Policy Framework Governing Carbon Taxes in Europe

3.1 Introduction

Europe has a dedicated vision for greening its economy. It has strived to achieve its green goals backed with concrete efforts. Examining its policies demonstrates that Europe relies on a diverse set of policy and legislative interventions. It is relevant to closely observe this, especially in the context of exploring carbon taxes. Accordingly, this chapter shall examine the work done on carbon taxes in the EU region specifically. This will help in putting into perspective the journey of environmental taxes in the EU.

3.2 Green efforts and EU

3.2.1 Carbon Border Adjustment Mechanism introduced by the EU

In 2021, it announced the launch of Carbon Border Adjustment Mechanism (CBAM), with an aim to fully introduce it by 2026. In late 2022, the European Parliament and the European Council have reached a provisional agreement on the CBAM.26 In April 2023, the CBAM Agreement was formally approved by the Council of the EU.27 In fact, the CBAM has been published in the Official Journal of the EU (at the time this article was going to the press in May 2023), paving the way for it to be applicable from October 2023 onwards.28

Simply put, a CBAM is a measure by which any import of goods into Europe from jurisdictions that do not have adequate environment safeguards are subjected to a tax, or a border adjustment, upon entry to Europe in order to offset the cost of compliance for higher environmental norms by companies in Europe.29 Such regional measures need to be examined closely while exploring the possibility of environmental taxation related interventions.

www.ey.com.

www.taxfoundation.org.

www.pwc.be.

www.ec.europa.eu.

3.2.2 EU’s Roadmap for Climate Action

Tax and finance policies are an important plank of the EU’s efforts to achieve a sustainable future.30 As part of the EU Climate Law and its ‘Fit for 55’ plan, the EU has set targets for reduction in carbon emissions.31 It has adopted an integrated approach of fiscal, environmental as well as taxation policy to achieve the end objective of mitigating climate change. It envisions an Emission Trading System (ETS), the Energy Taxation Directive (ETD), the CBAM along with EU Climate Law in order to achieve climate targets under the Paris Accord, as well as its own internal objectives of becoming a net neutral area.32 The ETD has explored a carbon tax in a way that is unique.33 The proposal for a revised ETD, to be implemented from 2023, provides that taxation of energy shall factor in the net content of their energy, moving away from a volume-based approach currently employed by most EU states.34 The proposed revised directive provides for a minimum level of taxation for EU member states with regard to their national duty rates. This tariff is expressed in Euro per gigajoule (EUR/GJ).35

The proposed revision is a welcome move, and will ensure a shift towards a more climate sensitive behaviour.36 The proposal has sought to address concerns on the regressive nature of such taxes by providing a moratorium period of 10 years for low income households along with a transition period of 10 years to adapt to the new tax rates.37 In my view, this will cushion the effect of the taxes and will give time to the lower earning bracket of tax payers to embrace this tax. This is a balanced approach and is worthy of being considered elsewhere as well. The way the state uses the revenue collected from the ETD is also a factor that will eventually ensure the success of the revised ETD, when it is passed.38

In my opinion, the interdisciplinary operation of carbon taxes and climate policies (as in the EU), is instructive and the way forward, whereby climate law, carbon taxes, CBAM and other relevant aspects are a bouquet of actions targeting climate change. This model has demonstrated a coordinated carbon taxation model that has been well received. During the foregoing observations in Chapter 2, we have engaged with the concept of a carbon tax and its formulation. In my opinion, if we are to synchronise our learnings in Chapter 2 and in Chapter 3, it can be seen that a well-designed carbon tax performs in a desirable manner when there is an enabling taxation policy as well researched linkages with other related policy dimensions.

Mark Bowler Smith, The Taxing Road to Sustainable Growth: Resource Productivity and Corporate Taxation (1st Edition, IBFD, 2013), 15–43.

www.europarl.europa.eu.

www.pwc.nl.

Ibid.

Ibid.

www.sustainablefutures.linklaters.com.

www.sidley.com.

www.eu.boell.org.

Ibid.

3.2.3 The War & its Impact on EU’s Green Goals

As has been felt in the EU, the war in Ukraine (the War) has mounted a risk to the realisation of its green goals.39 The extent to which the EU suffers as a whole on account of the War needs to be factored in the short to medium term basis. Especially for the purpose of this research project, there could be valuable lessons on manoeuvring such tricky bends in the road to realisation of climate goals using taxation as a means.

As explored in the foregoing discussion, the EU has set for itself ambitious target to mitigate climate change while ensuring space for growth. The War has demonstrated another formidable reason to move towards alternative sources of energy. The vision of a greener Europe has been validated by the shocks felt on account of the War across Europe. The insecurity surrounding energy supplies from Russia, cost escalation, shortage of supplies and overall impact on the life of people across Europe highlights one more reason to move away from carbon-based fuels. In my opinion, how this makes the green target slightly more challenging is by adding urgency to the cause. Accordingly, a comprehensive set of emergency response termed collectively as “RePowerEU” has been initiated by the EC in 2022. The aim of this is to reduce natural gas imports from Russia by the EU by two-thirds by the end of 2022, and thereafter in totality by 2030.40 The War, unexpected as it is and as undesirable as it will always be, has provided a silver lining of sorts for the EU’s overall climate goals.

www.eeas.europa.eu; Also see, www.euronews.com.

https://www.unclimatesummit.org.

3.3 The OECD

The OECD has come up with a Report in 2022 for G20 countries that encourages them to join its carbon mitigation forum that will encourage them to adopt low carbon footprint policies in order to generate resources.41 Again in November 2022, the OECD has published its Report titled ‘Turning Climate Targets into Climate Action’ to help countries achieve their respective green targets. For the purpose of this Report, the OECD reviewed carbon pricing, subsidies and energy taxes in about 71 countries. It concluded that while efforts in the domain of carbon prices and taxes are afoot globally, there is much to be done still that can impact climate goals effectively on a global level.42 Broadly similar observations have been also made in the IMF/OECD Report for the G20 Finance Ministers and Central Bank Governors on tax policy and climate change that was published in 2021.43

With these reports, the OECD has highlighted the obvious that currently efforts pertaining to carbon pricing, energy and environmental taxation in general are inadequate. I feel that through these reports, we may act in the direction of pursuing a comprehensive effort to look at environmental taxes in general, and carbon taxes in particular. The examples of countries that have enacted policies in this domain or have retracted their existing policies can provide valuable lessons. Bearing the failures in mind, and pegging the successful jurisdictions as models, a global model of climate sensitive and climate responsible taxation policy should be endeavoured. However, I also feel that organisations such as the OECD must play a larger role to build consensus while providing adequate space for dissent. This will enable a lasting policy outcome in a frontier area such as carbon taxation.

In February 2023, the OECD launched an ‘Inclusive Forum on Carbon Mitigation Approaches (IFCMA)’. The IFCMA aims to address global efforts at reducing carbon emissions. Importantly, it is an effort at collating the work from different countries on this aspect.44 It brings together about 133 countries representing 91 % of global Gross Domestic Product (GDP) and about 83 % of emissions.45 These highlights the need to focus efforts on a multilateral climate policy. I believe the effort to bring on board a diverse range of economies for addressing climate change will be a game-changer potentially. This is because a lasting policy impact and concrete outcomes can be ensured when large number of countries representing diverse economic profiles collaborate.

www.OECD.org.

Ibid.

www.OECD.org.

https://kluwertaxblog.com/. Also see, www.OECD.org.

www.OECD.org.

4 Alleviating the Effects of Climate Change by Tax Policy Intervention

4.1 Introduction

Climate finance is central to generating resources to deal with climate change. Any discourse on resource generation would inevitably concern taxation and fiscal policy of the concerned countries. This part will discuss how environment concerns can be addressed using taxes. In doing so, it will consider the importance of taxation for climate change.

4.2 Carbon Taxes as a means to Induce Climate Friendly Behaviour

Taxation has been long used for shaping social behaviour. There are certain kinds of taxes that are imposed with a view to discourage the use of certain class or kind of goods. Pigouvian taxes are imposed on goods whose decreased consumption will lead to more efficient outcomes.46 One such example of this could be smoking.47 Inducing tax-payers to move to a more climate responsible behaviour by adoption of cleaner/ newer technology, low emission fuel alternatives and more sustainable lifestyle can all be achieved by introducing carbon taxes. This has been seen to be effective in the case of Canada, which has a successful record with climate related tax and fiscal measures.48 Therefore, a carbon tax can be a means to a larger end, that is, combating climate change.

A greater international coordination can surely ensure the overall success of a carbon tax.49 Each nation could undertake an enormous effort to curb climate change through its tax policy. However, pollution and environmental degradation will not stop at the borders. Therefore, greater global coordination may be necessary in this regard. This coordination may be of two kinds. First is an internal coordination among countries and their respective tax systems. Second is a coordination between taxation and the policies dealing with climate change. Without aligning taxation (and even fiscal) policy to a country or region’s environmental goals, mitigating climate change would continue to be a daunting task. In my view, the synergy from a domestic policy and legal framework on the above lines is bound to influence global policy efforts as well.

At a theoretical level, arriving at the above situation would mean looking at the next logical step. Any effort always requires resources. In this case, ascertaining viable avenues of finance is central to a continued engagement with the issue. Financing climate mitigation is the heart of any effort. Moving away from conventional means of human existence which have been accomplished after years of fine-tuning technology and optimising costs would entail massive costs. For example, for a private individual to decide to buy an electric vehicle, rather than a car with a traditional engine, it would be possible only when the costs are within the person’s reach. Affordability of goods and services for mass consumption with a drastically reduced carbon emission rate will be possible only when perfect substitutes are in place. And providing consumers with such options is possible only when there is substantial curiosity to locate cleaner alternatives for most actions of daily occurrence. Dedicated R&D into clean technology alternatives could very well facilitate more wide-spread usage of clean technology, which is more climate friendly.

Similarly, when creating infrastructure which follows the requirements for climate and environment, enormous investment would be necessary. Also, disposing the waste from goods that will go out of use on account of switching to climate sensitive economy would entail costs. These are some of the examples that illustrate the paramount importance of ascertaining viable means to raise resources. This is how climate finance takes the centre stage.50 As per the UN, climate finance is defined as “local, national or transnational financing—drawn from public, private and alternative sources of financing— that seeks to support mitigation and adaptation actions that will address climate change.”51 To reiterate, climate finance is necessary for many significant efforts towards reducing emissions, which includes adaptation to climate change.52 It is imperative that the tax policy factors in climate change as part its narrative in order to align with efforts at mitigating it. This is how taxation policies and carbon taxes can help in raising resources, and inducing a shift towards cleaner and greener alternatives.

www.corporatefinanceinstitute.com.

Shekhar Sumit & Abhishek Tripathy, Smoking, Public Health and Law: Deliberating the Contours of a Moratorium on Smoking, 2 NUJS L. Rev. 93 (2009) 93. Also see, Jonathan Gruber, Government Policy Towards Smoking, 3 Yale J. Health Pol’y L. & Ethics 119 (2002).

www.canada.ca.

www.blogs.imf.org; Also See, www.imf.org.

www.un.org.

www.unfccc.int.

Ibid.

4.3 Elements of a Climate-Sensitive Tax Policy

Having seen why tax policy is necessary and how it can impact the discourse on climate change, it is worthwhile to explore the elements of such a tax policy. Any tax policy should have equity, certainty, convenience in terms of payment of taxes and these should be bolstered by an effective tax administration.53 These are seminal fundamentals which are true for any kind of tax policy and was enunciated by Adam Smith in his famous work, Wealth of Nations in 1776.54 A sound tax policy should be transparent and must owe accountability to the tax-payers. In my opinion, tax policy must accommodate contemporary challenges. Accordingly, a climate sensitive tax policy must endeavour to have the above features, and assimilate climate change mitigation with itself in order to be effective.

When talking of carbon taxes, it is also essential that there must be harmony between the fundamental principles of taxation and of environmental law. Established principles of environmental law, such as the ‘principle of polluter pays’, ‘the precautionary principle’, ‘the precautionary principle’,55 common but differentiated responsibility,56 and so on, must be balanced with tax related policies. A carbon tax, in its broad sense, that operates on the foundation of the polluter pays principle.57 The polluter pays principle lays down that anyone causing pollution, must bear the costs of the same.58 This in effect implies a production centric principle, where the producers of goods end up facing the tax. However, when a carbon tax is designed to target the consumers, it may seem unfair to the consumer who would lack the wherewithal to access better alternatives. Providing more climate friendly and accessible alternatives to the consumer will help them move to these goods.

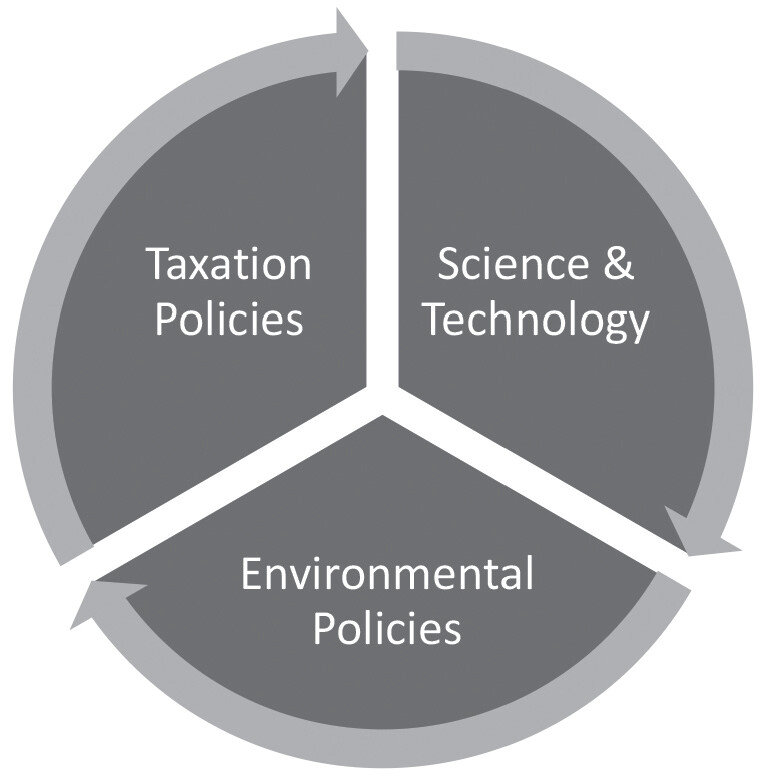

When we ask ourselves the all-important question, ‘What form should a carbon taxation policy take?’, in my opinion, the answer may be rather layered. A bouquet of interventions may make the outcome more efficient and comprehensive. This composite approach may also mean that more than one kind of intervention is employed to achieve the eventual realisation of climate mitigation goals.

Figure 2. Representation of the interdisciplinary relationship between environmental and other policies.

Ultimately, we must bear in mind that this is a complex area with many intertwined disciplines. Accordingly, continued inter-disciplinary research is most crucial to continuously update the tax model so that optimum results can be achieved.59 A positive intervention in each area of study affects the eventual outcome. Areas such as science, technology, geography, economics, taxation, sociology, and so on, are mutually reinforcing. It is all the more important why a comprehensive view is important in order to arrive at a viable solution for a climate sensitive tax policy.60

www.us.aicpa.org.

www.us.aicpa.org.

www.iisd.org, also see, www.europarl.europa.eu.

www.britannica.com. See Generally, Ellen Margrethe Basse & Sanford E. Gaines, ‘Common but Differentiated Responsibilities and Respective Capabilities as Part of the Post-2012 Climate Regime’, Nordic Environmental Law Journal, NMT 2010-2, 189.

www.oecd.org.

See Generally, Shyam Divan and Armin Rosencranz, Environmental Law and Policy in India: Cases, Material & Statutes (1st Edition, Oxford University Press, 2001).

Dr. Armin Rosencranz, et al., ‘Economic Approaches to Promotion of Clean Energy’, 10 NUJS L. Rev. 3 (2017) 848–860.

Ibid.

5 Conclusion

Carbon taxes are necessary for raising resources to tackle climate change. A uniform carbon tax could ensure that problems such as carbon leakage be altogether avoided. Carbon leakage denotes a practice when production moves to such countries that have less stringent laws concerning climate change and environmental degradation.61 Similar instances of tax planning and evasion specifically designed to side-step provisions aimed at mitigating climate change and environmental degradation could also be avoided. An enabling policy framework can provide the ecosystem within which a carbon tax can be implemented. The UN, the OECD and the the G-20 and other multi-lateral/inter-governmental bodies can work together on this to ensure that a carbon tax and a climate sensitive taxation policy can be conceptualised and put to practice.

Aside of all the theory and technical finesse, the philosophical realisation that climate change is a civilizational challenge is central to any action that we may subsequently take on climate change. Finance and taxes are the fuel that will keep our efforts to meet the challenge head-on, alive and dynamic. It is no longer about a country, a region or a continent taking steps to address climate change. It is also no longer about creating a façade of laws and policy behind which corporations and countries continue to play their petty games, and climate is of lowest significance. It has far moved from the mosaic of half-hearted and haphazard steps that at times confound than solve issues. Climate change is unravelling at a far greater speed than we realise. Its consequences are far deeper than we have bothered to imagine. And there is no better time to act than now.

Abhishek Tripathy (LLM, Uppsala) [BA, LLB (Hons.), NUJS]. The Author works with the Government of India, in the Indian Revenue Service, as a career civil servant.

www.lse.ac.uk.