During my forty years of professional career in the Tax administration and Business society I have noticed a never ending increase of complexity of income taxation of business activities. After my retirement this process seems to have accelerated even more during the latest two decades. In my view it is not only the complexity that can be questioned, but the mere idea of taxing business profit, i.e. net investment. In this paper I discuss, or criticize, the idea for the following reasons:

The supposed equality between an individual and a company inasmuch as they are both legal entities and

Income of a company being supposed to be comparable with the income of an individual.

1 Introduction

Taxation of business activities has since long been a common form of raising revenue for states and communities. In old times without social and economic status for individuals and a primitive monetary structure, the possibility to raise taxes from other sources was limited. In short, the production or the possession of land was taxed.1 In Sweden a general profit taxation of companies was introduced in 1861. An old taxation according to standard was then abolished.2

Since the introduction of company taxation, the tax has been a topic of discussion and innumerable changes to match arising problems. During the last decade an international campaign headed by OECD in order to prevent companies from avoiding taxes has under the keyword BEPS, Base erosion, Profit shifting, produced an array of suggestions and amendments to international taxation principles.

Skatteverket, De svenska skatternas historia, https://www.skatteverket.se/omoss/varverksamhet/skatternasochfolkbokforingenshistoria/desvenskaskatternashistoria.4.22501d9e166a8cb399f1f7d.html (hämtad den 28 juni 2023).

Virin, Niclas, Varför beskattas företagens vinster? http://niclasvirin.com/cuppsats.shtml (hämtad den 28 juni 2023).

2 Theoretical aspects

2.1 What is taxation?

The basic aim of taxation is to redistribute the result of a country’s production between individuals. Another aim is to redistribute individuals’ income over time. Everybody cannot keep the entire result of his labour for himself. Those who produce must leave part of it to those who for various reasons are unable to produce; e.g. children, students, sick, disabled and old people. Civil servants, whose employers cannot sell their services on a market, must also be provided for; e.g. government, parliament, authorities, defence, police, courts etc. To prevent the consequences of peoples’ overestimating their future income, taxation can also be used for redistribution of individuals’ income in time by public health and pension insurance arrangements. Taxation can be said to finance these individuals’ drawing rights on present and future production of goods and services.

In the long run there cannot be taxation unless there are new products and services created. Taxation of existing assets is confiscation. That does not mean that assets cannot be used as a measure of living standard and ability to pay taxes, but sustainable taxation presupposes production. There is no other sustainable tax base than what is produced. We can provide ourselves only with what is produced. In a modern economy everybody’s contribution is measured in an efficient way through the formation of wage structures. For that reason, it is natural to use salary as a tax basis. Many people also have an income of capital from share dividends. All these taxes are based on production (GNP) and are consequently sustainable. Capital income in form of interest equals interest cost and is thus not an effective tax base, although it is used for taxation in view of social justice.

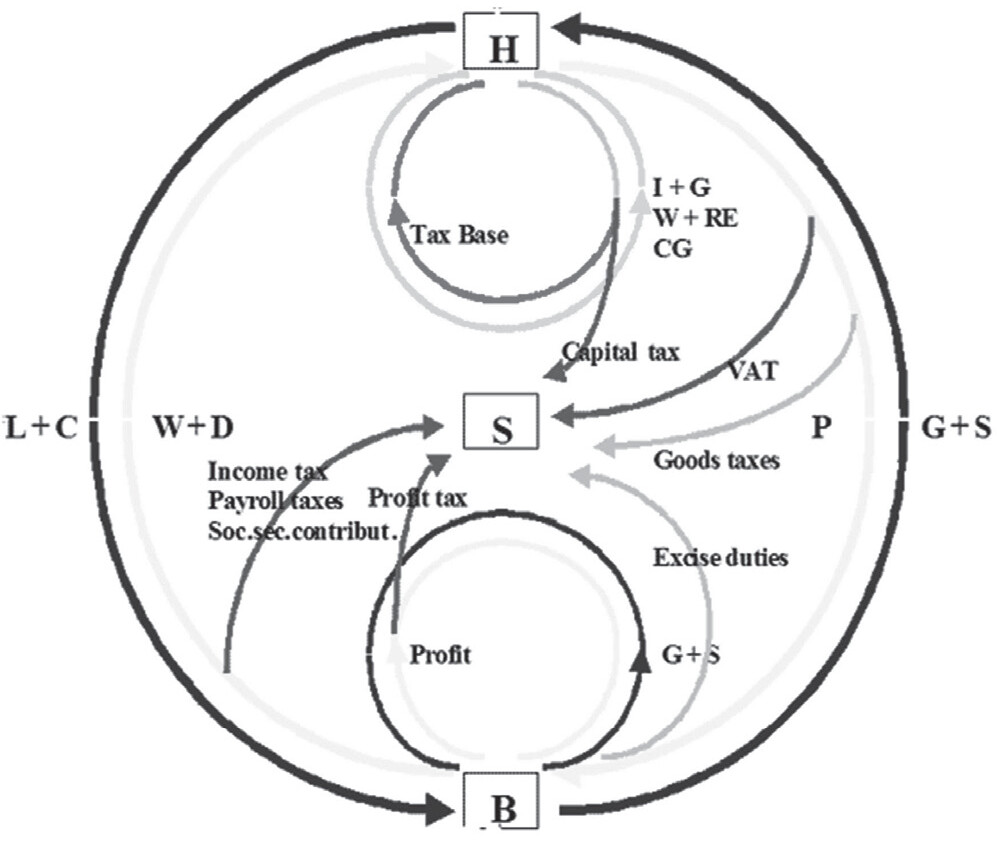

Another way to describe taxes’ role and function in the economic system is the following picture of the Economic circuit:

Picture 1: The economic circuit

H = Household sector, B = Business sector, S = State, L + C = Labour and Capital, W + D = Wages and Dividends, G + S = Goods and Services, P = Prices, I + G = Inheritance and Gifts, W + RE = Wealth and Real Estate, CG = Capital Gains

There is a flow of labour and capital from the household sector (H) to the business sector (B). In the opposite direction there is a flow of payments for labour (wages) and capital (dividends). The result of the production flows from the business sector to the household sector as goods and services, and the payment for it flows in the opposite direction. The purchasing power emanates from the wage and dividend payments. The flows of payments and the flows of capital and labour and goods and services are all dependent on each other.

There is a flow of semi-manufactures in the business sector and a flow of payments in the opposite direction. Values are created successively in this circulation and definitely when the products leave the business sector. This implies that resources have been consumed at market value and in a process been transformed to consumers’ products. If the transformation has been successful and the market evaluates the products higher than the consumed resources, profit has been created. Part of the profit remains with the companies as net investment, part of it is distributed as dividends to the shareholders. That means that part of the value of household wealth from ownership of business (shareholdings) has increased and part of it has been exchanged for cash. The payment of dividends generally triggers taxation.

The part of the value-added consisting of labour remuneration is a sustainable and normally used tax base. Frequently it is used twice: as income tax for the employee as well as wage cost (pay roll) tax and social security contributions for the employer. A flow of about the same size is also used as a tax base if there is a general consumption tax (VAT), so the income base can be used three times.

Consumption can also be taxed by way of special goods’ taxes and excise duties paid by the household sector or the business sector depending on the technique of collection, e.g. tobacco, alcohol, gambling and other vices, petrol, energy, environment pollution etc. Whether the taxes are sustainable or not depend on the tax rate; with a very high tax rate consumption expires – in other cases the tax can be seen as an extra consumption tax. The rationale for it is often to reduce or regulate undesirable consumption. A cynic would say that the reason for the taxation of tobacco, alcohol and gambling is not restriction of consumption; peoples’ devotion to vices makes them perfect tax bases. Such consumption is price inelastic.

Taxes are also collected from the household sector as a consequence of actions or events there: inheritance and gift, possession of wealth and real estate. The bases for these taxes are theoretically – unlike all other mentioned tax bases – not inexhaustible. Realization of capital gains can also be taxed. Whether that tax base is exhaustible or not depends on the growth of the value of the asset.

Finally, profit in the business sector is also used as a tax base. In many countries a tax is levied on the profit, although distributed profit is also taxed as dividend income with the shareholders, creating double taxation problems very difficult to master.

In the diagram it is easy to see that business profit tax is only a surtax on household income tax or rather a prepayment of household income tax. The tax reduces what otherwise would have been paid to employees or shareholders and reduces the tax bases for salary and payroll taxes, consumption taxes and dividend tax. You could say that company tax cannibalizes on other tax bases. Unlike other business taxes (e.g. taxes on energy, emissions, labour etc.), company tax has no effect on business behaviour other than making investments more expensive. The tax will unconditionally be rolled over on other economic actors. How, on whom and when this tax incidence will work, will depend on current elasticities on the markets of goods and services, labour and capital and it will be impossible to measure, not to mention predict or regulate.

Business tax is not indispensable. From the diagram you can see that tax on business profit not charged is not lost. Money and resources do not disappear in a black hole if the profits are not taxed.

2.2 Companies and individuals (households) in the economic system

Companies are set up to create goods and services in everybody’s interest and for everybody’s benefit. We need the products for our existence and survival, and we need the companies for their production. The companies have no other purpose. By producing in an efficient way, i.e. consuming resources of a certain value and creating values that mankind evaluates higher, the companies create what in accounting is called profit.3 Its efficiency is dependent on different limitations of the companies’ freedom of action related to custom and practice and legislation. Of course, the companies’ representatives must follow legal and other restrictions. The largest possible profit is not worth the social cost. A topical example would be limitations of liberties of actions of companies’ dependent on the fight against climate changes. The reported profits, i.e. the rise in value of the companies’ assets, equal – or are conceptually the same as – the net investment of the companies.4 To a certain extent the profit contains of financial deposits that – in case they are not used for dividends to the shareholders – will be used for investments in the future. The current consumption of resources is financed by current sales revenue.

This can be illustrated in the following way:

A company has an equity capital of 100.000. It invests 550.000 in buildings and machinery and 100.000 in inventory. The investment is partly financed by a loan of 200.000.

Sales | 1.000.000 | |

Business costs | 600.000 | |

Depreciation | 200.000 | |

Profit/Created values | 200.000 |

At year end the balance sheet is the following:

Building | 100.000 | |

Machinery | 250 000 | |

Inventory | 100.000 | |

Inventory | 50.000 | |

500.000 | ||

Loan | 200.000 | |

Equity | 100.000 | |

Profit/Created values | 200.000 | |

500.000 |

Profit has accrued through:

Gross investment in building and machinery | 550.000 |

Depreciation | –200.000 |

Performed investment; Building and machinery | 350.000 |

Inventory | 100.000 |

Total net investment | 450.000 |

Financed by loan | –200.000 |

Financed by equity | 250.000 |

Profit/Created values | –200.000 |

Cash | 50.000 |

Planned equity financed investment | –30.000 |

Available for shareholder dividends | 20.000 |

So, what is labelled profit is typically to a great extent investment in the company. What is available for the shareholders is normally a minor part. In order not to mislead readers of company reports I would suggest to swap the word profit for created values.

Observe that the loan would not be possible unless the lender (or somebody behind him) has created that value. Introducing borrowed capital may make the picture more difficult to understand, but it makes the illustration more realistic. To conclude: Existing investments (buildings, machinery, production facilities etc.) have in no part come into being unless profit has arisen. Profit = investment.

Business and household activities and their different functions in society are reflected in the national accounts. In 2020, Sweden’s gross national product (GNP)5 was SEK 4,977 billion. Household consumption was 2,183 billion, public consumption 1,327 billion, and gross investment (production facilities) 1,233 billion, whereof public investment 239 billion and the private sector 989 billion. Net export, i.e., foreign consumption, was 230 and inventory growth 4 billion. Total consumption was thus just over 75 percent of GNP and gross investment a little less than 25. The quotas are stable over the years. If depreciation/reinvestment is estimated at 20 percent, net investment/net business profit would be SEK 790 billion. With a tax rate of the current 20,6 percent that would give a company tax revenue of SEK 163 billion. In 2020 the tax on business profit was SEK 143 billion, i.e., less than 7 percent of all taxes.

GNP is a measure of the economic activity in a country. Investments are added to salaries, although that implies a double calculation. In the long run investment will be depreciated and be a part of values (salaries) created in the future. But adding them together in the GNP tables gives a better picture of the present economic climate. In reality investment and salary are, however, opposite phenomena. Investment represents construction whereas salary represents consumption. What was once produced will be consumed in the long run, and everything consumed has once been produced. This double calculation (acceptable in the description of the nations’ economic activities) seems to have been accepted and adopted for the construction of the tax system.6 In Swedish tax law this is completely evident. The wordings of the initial articles of the sections treating salary and other personal income (Chap. 10 § 1 ITA) on the one hand and business income (Chap. 13 § 1 ITA) on the other are exactly, word by word, the same mutatis mutandis. It is completely clear that the legislator regards the two kinds of income as part of one unit, although they are not values that can be added on the same scale. It is also indifferent to the legislator whether an income is derived from employment or business activities.7 The Swedish legislator evidently does not see any difference between the activities of an individual and a company regarding the tax liability, although the result of the activities of a self-employed – after deduction of the tax from the amounting result – is directly available for his consumption. The company’s result, contrariwise, can be used only for investing (or paying dividends). The company has no ability to consume. To the protection of the interest of the shareholders and creditors there are even legal provisions against the exhaustion of the company’s assets contrary to the articles of association. The Swedish legislation on association is even stricter and does in fact also prohibit loans to shareholders and interested parties.8 So, as long as the profits are kept with the company, they are inaccessible for private use. If they were used (contrary to law), they should of course be subject to tax with the recipients, which is the case in today’s tax system in Sweden.

Net national product (NNP) is a measure corresponding to GNP minus depreciation of assets. Business net profit equals performed net investment plus the value of monetary9 (cash, bank accounts etc.) net holdings. So, in fact taxing business income is the same as taxing investment. Business income tax should consequently be named investment tax.

Another consequence of the misconception of business profit being equal to income is the idea of taxing dividends. By paying dividend the companies or the shareholders are not engaged in creating new values. The dividend is simply and nothing more a transfer of an asset of the shareholders fortune from one pocket to another; the value received by the shareholder is taken from the value of his shares. The value of his fortune is the same as before. This misconception has given rise to the eternal and insoluble problems of double taxation of company profit; not only is the company profit taxed, but the same amount (except company tax) is taxed as dividend “income” too. The solution to the problem is of course the insight that the company profit is not an income comparable to salary income. The origin of the dividend is, however, the new values created by the company which motivates its taxation. The taxation of the dividend could be made either on the company paying it, or on the shareholder receiving it.10 It is interminably much easier to tax the dividend than the profit. Another argument for taxing the dividend is that it is not until the dividend has been paid that the “income” can be expended.

I believe that this lack of knowledge could explain the difficulty in understanding why company profit taxation is an anomaly that easily and to great advantage could be abolished. Even more important, why company taxation is also harmful and an obstacle to economic growth and the creation of human welfare.

Profit is typically not a heap of coins and banknotes or gold bars, but the balance between innumerable entries in the ledgers of costs and receipts and the ensuing change of value of the company’s net assets. Only in a company that has sold all its assets profit may be represented by money.

I treat the business society as one single business unit. In reality the business society is divided in thousands of separate units, why net investments in reality are to a great extent debt financed. But loans are to be repaid and that presupposes future profits. These net investments have no other purposes than ameliorate the possibilities to produce goods and services in the future. It is the value of these net investments that partly is handed over to the state in case there is a business tax.

Prop. 2021/22:1 Bilaga 2 s. 3.

My personal view is, however, that this aspect has never come to the mind of the legislator. In my career in the Swedish tax society, I have never heard it pronounced.

The legislators’ opinion would hold true if the business were conducted in the form of sole proprietorship, where the result of the activities accrues to the owner. But in that case, it is rather a question of taxation of an individual deriving consumption capacity regardless how that is done.

Company Act, Sec 21. Aktiebolagslag (2005:551), Kapitel 21.

Drawing rights on future investment acquisitions.

Estonia taxes companies only when and to the extent that profits are distributed to the shareholders. Received dividend income is tax exempt. In practice this is the same as no company tax and a definite withholding tax on received dividend income.

2.3 Company taxation, investment and capital growth

If company taxation were abolished the required rate of return on investments would sink as a consequence of the elimination of a cost item directly and exclusively related to the action. That means that investments that are unprofitable today would be made. New investments induce an increase of salaries, sales and profits and of taxes on the bases mentioned. How salaries, dividends and consumption – and the taxes on the bases – would be affected is difficult to assess. In the short term, there are clear indications that investors bear company taxation, while in the longer term there is no reason that company taxation on the whole should affect the allocation of the results of production between investors and wage earners. Analyses of the economic effects of the abolition of company taxation suggest considerable gains for investment, for government finances etc. In our book11 Erik Norrman has given account for established theoretical opinions on the economic consequences of company tax. Without the mathematical precision of his reasoning and disregarding the size of the consequences you can draw the same fundamental conclusion by the following reasoning.

By introducing a tax on the activities of companies you not only raise the required rate of return on investment and make marginal investments unprofitable reducing the general level of investment in the economy. You also trigger the companies’ activities to minimize the new cost item. That includes investment and business decisions as well as blatant tax reduction actions. Also, lawyers, tax consultants and academics as well as tax authorities and tax courts and other official entities will be busy with a new task. Resources spent on it consume resources for activities that would otherwise have been spent on production in the companies and other activities in the private sector and administration. If the companies are successful in rolling over the new cost on salaries it also implies a reduction of income and payroll taxes. Together with the restriction on investment activities due to raised demand on rate of return, and the administration of the company taxation system it is highly unlikely that the tax will give any revenue at all.

In view of the fact that collecting taxes from companies that are financed by employees, consumers and shareholders does not create more money for the treasury, the whole procedure appears to be a meaningless and resource consuming end in itself. I cannot see any reason why the procedure would give a larger production result and larger revenue for the treasury than taxing the individuals directly. Rather the contrary; the more complicated system and the more entities engaged the greater the risk of losses.

A crucial question in connection with the abolition of company taxation in one country is how other countries would react. Historical experience shows that it is likely that a substantial reduction in company taxation in one country will be seen by other countries as an aggressive act aimed at attracting capital from abroad.12 In the worst case, other countries could introduce special rules aimed at penalizing companies investing in a country with no company tax. Whether this is a problem is unclear. Foreign companies may avoid the country as an investing country, because their home countries tax them for foreign low taxed income (CFC-legislation). You could, however, also see that effect as a protection of the country’s companies from foreign competition without introducing import duties.

The fact that company taxes are withdrawn from states as a consequence of international tax planning does not necessarily mean that total tax revenues are reduced. There are only redistributions between tax subjects and states, and redistributions in time and between different kinds of tax. The tax which the companies don’t pay is no loss to the world economy. Nobody eats coins and bills. The goods produced and services rendered have been produced, invested and consumed. The taxes not paid have “only” had the effect that the disposition of an expected share of created resources has not been handed over to the tax authorities but is kept within the business sphere. That could of course be troublesome enough; the states do not receive the taxes they had budgeted for, or other states have received “their” taxes, which creates political tensions between the states. Competition conditions are perturbed. In the worst case profits are hidden in offshore tax shelters.

However, the missing company taxes induce new investments through reduced requirements of rate of return. As was mentioned above the new investments generate in turn increasing payments for labour and/or proceeds due to increased employment and/or increased share dividends, all being taxable items. With increased wage payments and share dividends also the base for different consumption taxes will be increased. From where would the money to pay for the company tax have come if not from the accounts for salary costs, selling proceeds, and share dividends? From Heaven?

Norrman, Erik & Virin, Niclas, Slopad bolagsskatt – analys och konsekvenser, Stockholm, 2007.

Presently, as an outcome of the OECD-induced campaign against Base Erosion, Profit Shifting (BEPS), there is a plan for an international agreement of a minimum tax rate of 15 percent.

3 Conclusion

From the scope of the endeavours to create the perfect company tax system, presently illustrated by the work performed by OECD in the BEPS project, you would expect business taxation to be one of the greatest problems and challenges to the world economy and even mankind. And yet, as said above, business taxation is based on a misconception of income being comparable to profit/net investment, raises little real revenue to the states, and as everybody can understand from the ambitious work by OECD, entails extremely difficult technical and judicial problems.

The only aim for business companies is to – within the framework of a number of social, cultural, legal etc. restrictions – create value, i.e. consume in a production process resources of a value by the public appreciated lower than that of the public’s appreciation of the result of the production. This activity is facilitated by an existing production structure, i.e., net investments accumulated during several decades in business companies, organizations, and authorities. The base for the company tax is those and future net investments (plus dividends) by the companies. In cases where the companies do not distribute their profits, net investment is the tax base.13 How can the shortening of the lever for the material progress of mankind be defended? If you withdraw part of their profit from the companies the profitability of their investments will decrease, and the marginal investment will not be made. Employment and the salary total will be lower than otherwise, the profit and compensation to the shareholders would be reduced. Consumption would decrease. In short, everything to be shared by those who ultimately pay ALL taxes will be less, no matter whether the taxes formally are paid by individuals, companies or other organizations. To tax business companies’ profits is only a way to hide who in fact pays for the tax. In the modern globalized world with companies present in numerous countries it is also a source for unnecessary international tensions and fight for the tax base.

In the long run a new level of equilibrium between remunerations to capital owners and employees would be installed unaffected by a company tax. Everything would be as earlier except all problems and consequences related to the tax. The item “income tax” would disappear from the income statements. Companies would be deliberated from stumbling blocks and unexpected tripwires. Valuable expertise in the academia, courts, tax authorities, consulting firms etc. could find more useful occupation to serve mankind.

The abolition of corporate taxation would in general hardly give rise to any negative effects that could not be overcome. The positive effects, on the other hand, would be many and almost overwhelming. The problems of the legal aggressive and international tax planning that are so upsetting to politicians and the public would disappear in a pinch. Who would then direct the income to a jurisdiction that taxes profits? Or rather, investment decisions would be made on business considerations only.

How could anybody argue for a taxation expressly aiming at the one and only phenomenon that produces values for the survival of mankind? Company profit taxation is based on a misconception of the concept of profit and induces a resource devouring self-destructive behaviour. It serves no revenue purpose, and it is of great economic interest to tax consultants and academics only.

Abolish company taxation.

Niclas Virin har varit Allmänt ombud för mellankommunala mål, Skattedirektör i Riksskatteverket, Bankdirektör i Handelsbanken samt ledamot av Skatterättsnämnden och Näringlivets skattedelegation.

In the long run not invested profit will by definition be distributed.